oregon wbf tax rate

The pure premium rate decrease is effective January 1 2020 but employers will see the changes when they renew their policies in 2020. Who is exempt from oregon wbf.

Oregon Payroll Tax And Registration Guide Peo Guide

The WBF assessment rate which varies from year to year is xxx cents for each hour or partial hour worked.

. The Department of Consumer and Business Services has set the WBF assessment rate for calendar year 2021 at 22 cents per hour. Detailed Oregon state income tax rates and brackets are available on this page. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The Oregon Workers Benefit Fund WBF. Really any payroll item that is calculated using hours that isnt sick or vacation and is not. Oregon workers are subject to Workers Benefit Fund WBF assessment tax.

Right now the only option is to make Holiday regular pay so its treated like worked hours. For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years. What is the Oregon WBF tax rate.

The Oregon income tax has four tax brackets with a maximum marginal income tax of 990 as of 2022. The detailed information for Oregon Wbf Assessment Rate 2020 is provided. If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee covered under.

Box 4D Use the current LTD tax rate. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged. The WBF assessment is a payroll assessment that employers of Oregon workers have paid since 1966.

24 new employer rate Special payroll tax offset. 33 cents per hour. We recommend that the wbf assessment rate be lowered to a combined 22 cents per hour for calendar year 2020.

This assessment is calculated based on employees per hour worked. 84 percent decrease 2019. For 2022 the rate is 22 cents per hour.

From 1966 to 1994 subject Oregon employers paid this assessment then commonly. Tax Formula Set Up. 165 cents per hour.

009 00009 for 1st quarter 009 00009 for 2nd. Ad Obtaining BIN More Fillable Forms Register and Subscribe Now. The detailed information for.

UI_Tax_Rate NUMBER 55 UI tax rate used to calculate the tax owed 16a UI_Tax 19a UI_Prepaid_Tax UI tax prepaid during the quarter 20a 6a Total_UI_Tax_Due 22a 13b 14b 15b. Enter the tax formula and table rate information. 28 cents per hour.

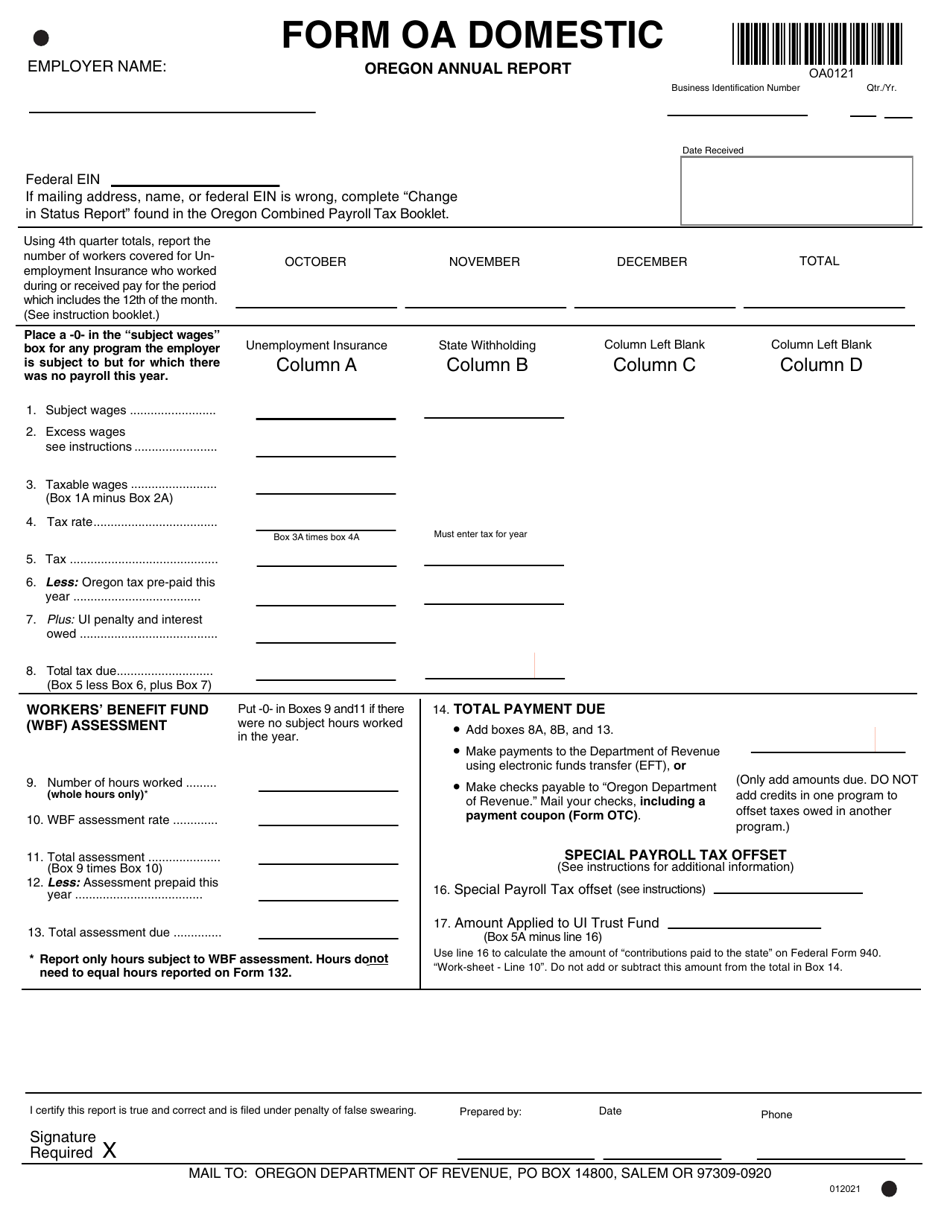

For example The 2017-2018 rate is 28 cents for each hour or partial hour and. Workers Compensation and Workers Benefit Fund Assessment Rates for 2022 Please share this notice with your payroll and risk management staff Insurance premium. Oregon has an additional requirement of Form OR-WR Oregon Annual Withholding Tax Reconciliation Report to be filed only if there is a tax.

The combination of the changes to all of the workers. The oregon state state tax calculator is. For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years.

54 Taxable base tax rate. Line 10 of the. The oregon 2021 state unemployment insurance sui tax rates range from 12 to 54 on rate schedule iv up from 07 to 54 on rate schedule ii for 2020 and 09 to 54 on rate.

WBF Assessment Rate Employers Portion Workers Portion. Enter a Tax ID. 09 Taxable maximum rate.

You are responsible for any necessary changes to this rate. 165 cents per hour.

1875 Liberty Seated Dime Love Token W B F 136679 Ebay

Oregon Payroll Tax And Registration Guide Peo Guide

Oregon Payroll Tax And Registration Guide Peo Guide

Mens Nike Air Force 1 Low Wbf World Basketball Festival Pack China Size 9 Yellow Ebay

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

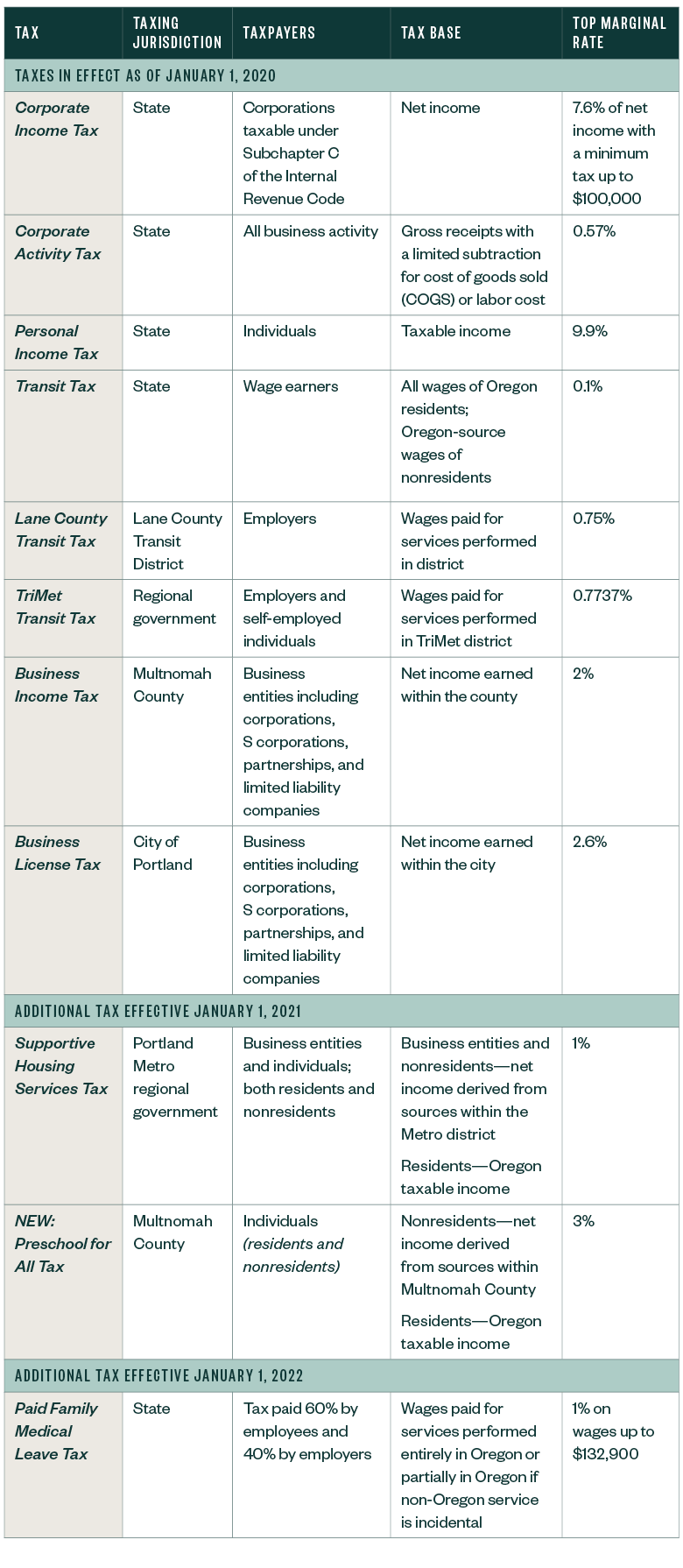

Oregon And Washington Tax Comparison Sheet By Hfo Investment Real Estate Issuu

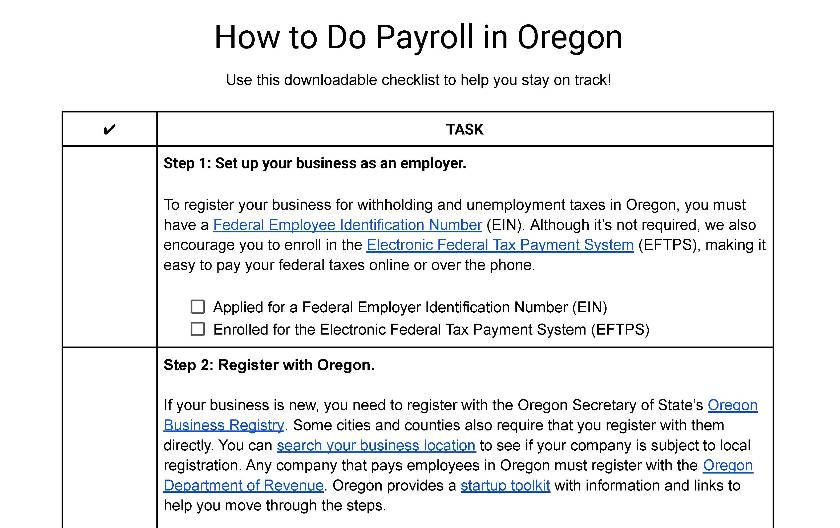

How To Do Payroll In Oregon What Employers Need To Know

Oregon Workers Compensation Insurer Premium Assessment Report To Department Of Business And Consumer Services Or Workers Compensation Premium Assessment Report Us Legal Forms

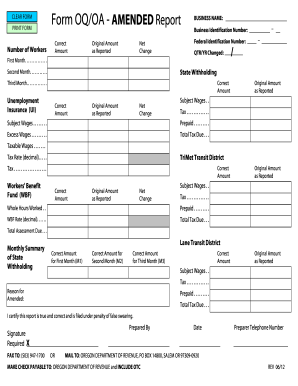

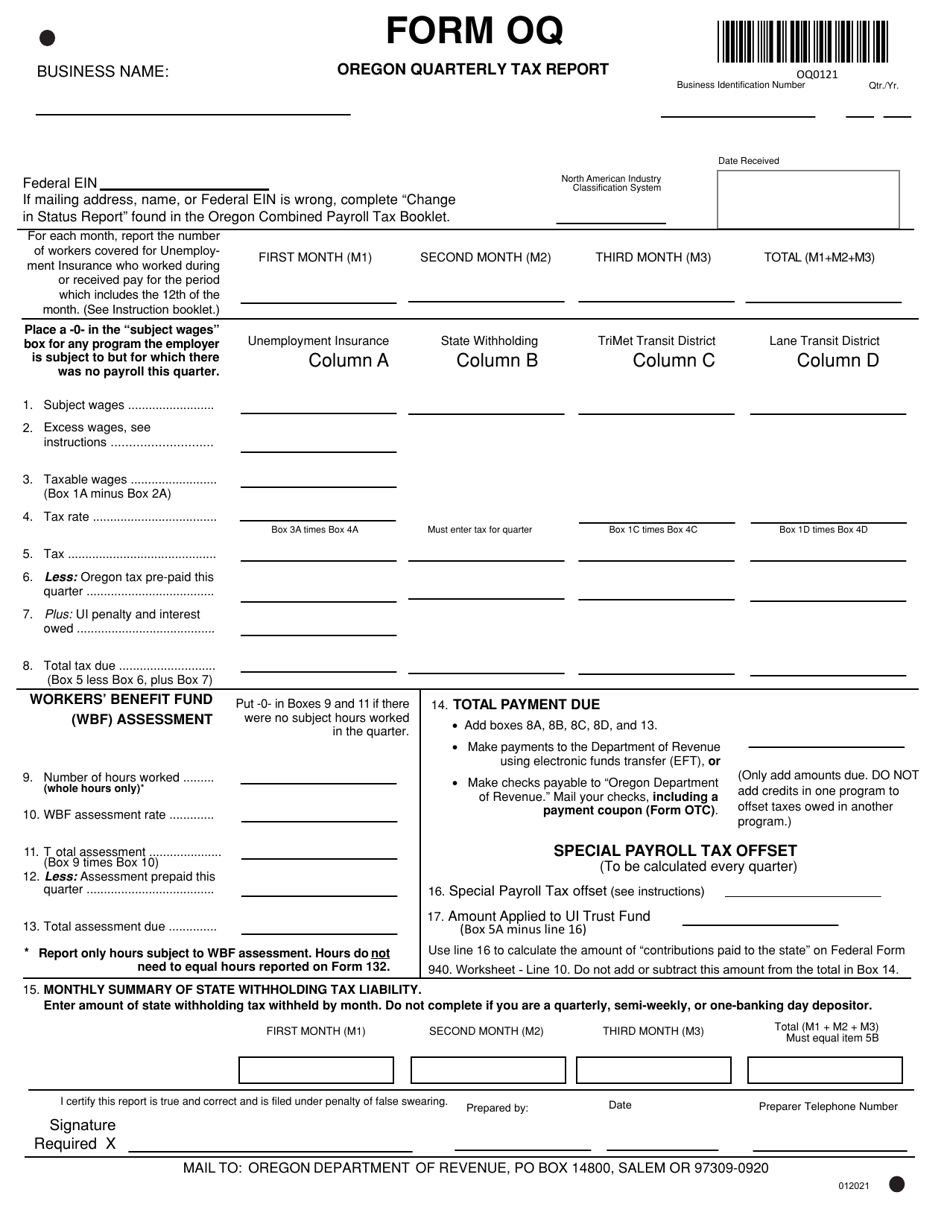

Or Dor Oq Oa 2012 2022 Fill Out Tax Template Online

The Complete Guide To Oregon Payroll For Businesses 2022

Form Oa Domestic Download Fillable Pdf Or Fill Online Oregon Annual Report Oregon Templateroller

Oregon Combined Payroll Tax Report Pdf Free Download

Oregon Workers Compensation Employee Withholding Us Legal Forms

Form Oq Download Fillable Pdf Or Fill Online Oregon Quarterly Tax Report Oregon Templateroller

Workers Compensation Market Characteristics Report

New Portland Tax Further Complicates Tax Landscape

Oregon Workers Benefit Fund Payroll Tax

My Money Map A Complete Financial Breakdown Financial Mechanic